After leaving behind his successful career as the host of late-night talk shows, Jay Leno launched a web series on nbc.com (2015 to 2022) about cars.

Jay Leno’s Garage, now appearing to more than 3.7 million subscribers on YouTube, allows the comedian to share his passion for cars and bikes with his audience.

In November 2022, the former Tonight Show host was badly burned when a fire broke out in his Burbank, California garage.

“I got some serious burns from a gasoline fire.” Leno told Variety at the time “I am OK. Just need a week or two to get back on my feet.”

According to reports, the now 74-year-old man was working under a car when the fire sparked. He suffered third degree burns on his face and got a new left ear after losing his first one to the fire.

Unfortunately, his luck didn’t get any better.

Only two months after the fire, he suffered a broken collarbone, two cracked ribs and two cracked kneecaps in a motorcycle accident.

‘Treats Mavis like gold’

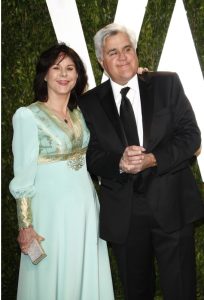

Despite his body breaking down with aging, passion-related accidents and high cholesterol, the one thing that holds strong in his life is his love for Mavis, who he married in 1980.

“I always tell guys when they meet a woman, ‘Marry your conscience. Marry someone who’s the person you wish you could be and it works out okay.” Leno tells People of his enduring love with Mavis, now 77.

After 45 years together, the childless couple started facing some hardships.

Mavis was diagnosed with dementia and her condition is rapidly declining.

In April 2024, Leno was granted a conservatorship over his wife’s estate by a Los Angeles Superior Court judge who ruled the measure was “necessary and appropriate.”

According to court documents obtained by Entertainment Tonight, “Mavis has been progressively losing capacity and orientation to space and time for several years.”

The filing also says and “Jay is fully capable of continuing support for Mavis’ physical and financial needs, as he has throughout their marriage,” but her “current condition renders her incapable of executing the estate plan.”

Included in the documents is a statement from her neurologist Dr. Cohen: “Sometimes [Mavis] does not know her husband, Jay, nor her date of birth.”

Cohen, Mavis’ attending doctor at Cedars Sinai, adds that Leno “loves his wife very much” and “treats [Mavis] like gold.”

‘No one lives forever’

Only months later, In Touch reports that Leno is now preparing for his own death, making end-of-life arrangements so his fortunes are delivered to the rightful beneficiaries.

The filing reads: “No one lives forever, and the actions taken by Mr. Leno are reasonable and necessary for his and Mavis’ protection. Mavis does not object to the petition and in my opinion consents to it. Mr. Leno is her protector, and she trusts him. This estate planning is in her best interest and protects her interests.”

Leno’s latest filing details provisions for Mavis’ care and discloses that the couple intends to stay in their home “for as long as reasonably possible,” using their money for “assistance from household employees or caregivers as may be necessary.”

If Leno dies first, “the estate will divide into the Leno Marital Trust…it will have the Leno Collection and any real property housing Leno Collection. It will be irrevocable, and the survivor receives all income, plus principal for reasonable support. After the survivor’s death, after-tax balance will be distributed, along with the Leno Trust to JDM.”

The Leno Collection is Leno’s collection of automobiles and motorcycles, that’s valued at more than $52 million, and any real property.

Leno also instructed the JDM Foundation, a charity he launched in 1988, to open a museum with his automobile collection, and he’s already named the three initial directors.

In addition, Leno is leaving $7 million to Mavis’ brother Rikki Nicholson, who lives next door, and to his nephew Richard Leno.

The court-appointed official said Leno’s amendments to the trust will likely be approved.

It’s hard to imagine a world without Jay Leno! Please let us know what you think and then share this story so we can send Leno and Mavis a lot of love!

Son donates hair to his mom who has been battling a recurrent brain tumor for nearly 20 years

What was intended to be a joke ended up being one of the greatest gifts a mother could ever have from her son.

An Arizona guy grew out his hair for over three years in order to give it to his mother, who lost her hair due to radiation treatment.

Matt Shaha declared, “It makes perfect sense.” “In the first place, she gave me the hair.”

Melanie Shaha battled a benign brain tumor for many years.

She remarked, “I had surgery twice, in 2003 and 2006, for a pituitary tumor that was recurrent and benign brain tumor.”

After two successful surgeries to remove it, she was prescribed radiation in 2017 when it reappeared.

“I inquired with my doctor, ‘Will my hair fall out?’” and they replied, “No.”

She lost her hair three months later.

A TWO-DAY WEEK…

She remarked today, “When you don’t have hair, you stand out like a sore thumb and kind people can say things that make you cry.” “Looking sick bothers me more than actually being sick.” At the store, I’d want to fit in rather than stand out.

Shortly after Melanie started experiencing hair loss, her son, who is 27 years old, made a joke one day about growing his hair out and getting a wig for her.

I began working with Matt Shaha a year ago, and he is one of the most giving people I have ever met. Among the original…

Even though Melanie’s son was receiving such a nice offer, she didn’t want to burden him with it.

But Matt had a different perspective. For the next 2.5 years, he let his hair grow out. He went to his mother’s house with a few coworkers when his hair was at the right length, and they chopped it off.

I began working with Matt Shaha a year ago, and he is one of the most giving people I have ever met. Among the original…

Melanie remarked, “We were so excited that we started crying when they started cutting.”

He even paid the $2,000 to have the wig created when the time came.

The mother and son team discovered a wigmaker who created a lighter and more comfortable wig by hand-stitting the hair. Melanie had the wig trimmed and styled as soon as it arrived.

“It’s the first time I’ve seen my mom look like that since she lost it, so it’s been about four years,” Matt remarked upon seeing her in it.

Melanie, smitten with her new appearance, conceded that surpassing her son’s present would be difficult. “It definitely fills your heart.”

Melanie is very happy! Look at her expression! Matt is even grinning broadly. For them both and their families, I adore this.

Leave a Reply